Wyoming Credit: Reliable Financial Solutions for every single Phase of Life

Wyoming Credit: Reliable Financial Solutions for every single Phase of Life

Blog Article

Why You Should Choose Cooperative Credit Union for Financial Security

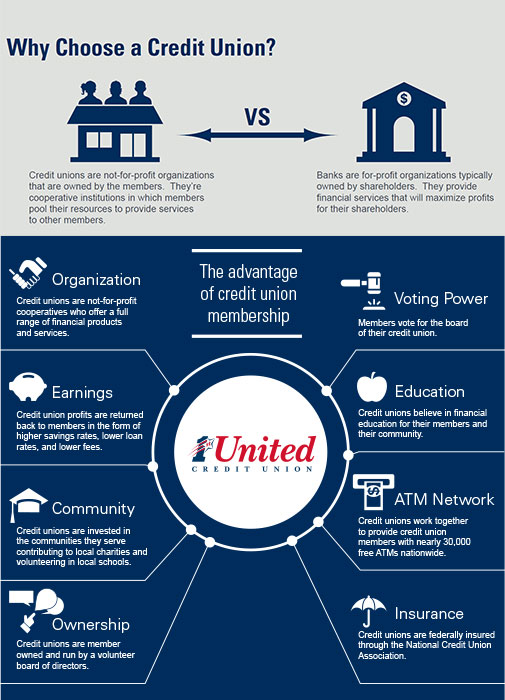

Cooperative credit union stand as pillars of monetary stability for numerous individuals and neighborhoods, providing a special approach to banking that prioritizes their members' well-being. Their commitment to lower costs, affordable prices, and customized customer support establishes them aside from standard financial institutions. There's more to credit report unions than just economic advantages; they additionally promote a sense of community and empowerment amongst their members. By choosing lending institution, you not only safeguard your monetary future however also enter into a supportive network that values your economic success.

Reduced Fees and Competitive Prices

One of the essential advantages of credit score unions is their not-for-profit framework, permitting them to focus on participant advantages over making best use of profits. Additionally, credit scores unions usually supply much more competitive interest rates on savings accounts and loans, translating to far better returns for participants and reduced borrowing costs.

Personalized Client Solution

Offering customized aid and personalized remedies, credit score unions prioritize individualized customer service to fulfill members' certain monetary needs effectively. Credit union personnel usually take the time to listen diligently to participants' issues and supply customized suggestions based on their specific needs.

One secret element of tailored client service at cooperative credit union is the emphasis on economic education and learning. Credit history union reps are committed to helping members understand various monetary products and services, equipping them to make educated choices (Credit Union Cheyenne WY). Whether a member is seeking to open up an interest-bearing account, look for a financing, or prepare for retired life, cooperative credit union provide individualized support every step of the method

Furthermore, lending institution typically go the added mile to make sure that their participants feel valued and supported. By building solid partnerships and cultivating a feeling of area, cooperative credit union create a welcoming setting where participants can trust that their financial health remains in great hands.

Strong Neighborhood Focus

With a commitment to sustaining and promoting local links area efforts, lending institution focus on a solid neighborhood focus in their procedures - Credit Union Cheyenne. Unlike standard banks, credit history unions are member-owned financial establishments that operate for the advantage of their members and the communities they offer. This unique framework permits cooperative credit union to concentrate on the well-being of their members and the local neighborhood as opposed to entirely on generating revenues for outside shareholders

Credit unions commonly engage in different area outreach programs, sponsor neighborhood events, and work together with other companies to deal with area needs. By purchasing the area, cooperative credit union aid boost local economic situations, produce work opportunities, and enhance total lifestyle for locals. Furthermore, lending institution are understood for their participation in monetary proficiency programs, supplying educational resources and workshops to assist neighborhood participants make educated economic decisions.

Financial Education and Aid

In promoting economic literacy and offering assistance to individuals in requirement, cooperative credit union play an important duty in equipping communities towards financial stability. Among the key advantages of cooperative credit YOURURL.com union is their emphasis on offering economic education to their participants. By using workshops, seminars, and individually therapy, credit report unions help individuals much better understand budgeting, saving, spending, and managing financial obligation. This education outfits members with the understanding and abilities needed to make educated economic choices, ultimately causing boosted economic well-being.

Additionally, cooperative credit union often provide support to members dealing with monetary problems. Whether it's with low-interest finances, versatile payment strategies, check it out or monetary counseling, credit score unions are devoted to aiding their participants get rid of difficulties and accomplish financial security. This tailored strategy collections debt unions apart from typical financial institutions, as they focus on the monetary health of their participants above all else.

Member-Driven Decision Making

Members of lending institution have the opportunity to voice their viewpoints, offer comments, and also run for settings on the board of directors. This level of engagement fosters a sense of ownership and community among the members, as they have a straight effect on the instructions and plans of the credit rating union. By actively entailing members in decision-making, credit history unions can better tailor their services to fulfill the one-of-a-kind demands of their neighborhood.

Eventually, member-driven decision making not only improves the general participant experience yet likewise advertises openness, depend on, and look at more info responsibility within the lending institution. It showcases the participating nature of cooperative credit union and their dedication to offering the ideal passions of their members.

Conclusion

Finally, credit unions supply a compelling choice for economic stability. With lower costs, affordable rates, individualized client service, a strong area focus, and a dedication to monetary education and help, cooperative credit union focus on member advantages and empowerment. Through member-driven decision-making procedures, credit scores unions advertise transparency and liability, guaranteeing a secure financial future for their participants.

Credit report unions stand as pillars of monetary security for numerous people and communities, providing an one-of-a-kind method to financial that prioritizes their participants' well-being. Unlike conventional financial institutions, credit scores unions are member-owned economic institutions that operate for the benefit of their participants and the areas they serve. Furthermore, debt unions are known for their involvement in monetary proficiency programs, using educational sources and workshops to assist community members make educated financial decisions.

Whether it's via low-interest financings, adaptable repayment plans, or financial counseling, debt unions are committed to helping their members conquer difficulties and accomplish economic security. With reduced costs, affordable prices, individualized consumer solution, a solid neighborhood emphasis, and a dedication to monetary education and support, credit unions focus on participant advantages and empowerment.

Report this page